18+ Assumable mortgage

There may be a. Fast VA Loan Preapproval.

845 Us Hwy 80 East Dublin Ga 31027 Mobile Home Rv Community For Sale Loopnet Com

An assumable mortgage is a mortgage that can be transferred from a seller to a buyer.

. Compare More Than Just Rates. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You.

Well heres the good news. As of 2014 FHA and VA assumable mortgages make up. Department of Housing and Urban Development 451 7th Street SW Washington DC 20410 T.

An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower. What is an adjustable-rate. Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You.

An assumable mortgage is a mortgage loan that another borrower can take over while keeping the original terms and conditions. Your Manufactured Home Lending Source. Contact a Loan Specialist.

How to assume a mortgage when buying a house. Assumable mortgages are types of mortgages that can be transferred to another party at the originally agreed-upon terms which include the. Weve helped thousands of homeowners catch up on missed payments and find the right plan for their situation.

The buyer takes over the loans rate repayment period current principal balance. To put it simply an assumable mortgage loan is a type of financing arrangement that allows a homebuyer to take over the mortgage of the current seller. Trusted VA Loan Lender of 300000 Veterans Nationwide.

An assumable mortgage allows a buyer to take over or assume the sellers home loan. Mortgage assumption is the conveyance of the terms and balance of an existing mortgage to the purchaser of a financed property. 21st Mortgage Corporation is a full service lender specializing in manufactured and mobile home loans.

Typically this entails a home buyer taking over the home. These clauses are not common in mortgage contracts and even if yours has one the lender still has the right to deny the request. Ad Check Your FHA Mortgage Eligibility Today.

Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. If the buyer is VA-eligible then a military mortgage is a popular zero-down option for financing a VA REO property. Once the loan is assumed by the buyer the seller is no longer responsible for repaying it.

Savings Include Low Down Payment. An assumable mortgage allows someone to find a house they want to buy and take over the sellers existing home loan without applying for a new mortgage. We originate and service a variety of.

An assumable mortgage is an existing loan held by a homeowner who can transfer the loan to a buyer with the lenders approval when they sell. Find A Lender That Offers Great Service. Get Your VA Loan.

Department of Housing and Urban Development. Compare More Than Just Rates. Vendee financing has 15- and 30-year fixed-rate terms.

Yet by December 1980 the average mortgage rate stood at. VA Loan Expertise Personal Service. Find A Lender That Offers Great Service.

Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new mortgage to. Most likely you were looking for a website name and you have typed in this website address to see if its available.

Ljcxtm6aby4f1m

Alisha Stockton Residential Real Estate Professional Home Facebook

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha

New Cheat Sheet On Types Of Mortgages Enjoy Real Estate Infographic Mortgage Cheat Sheets

Benefits Of Buying A Home With A Va Mortgage Loan

Alisha Stockton Residential Real Estate Professional Home Facebook

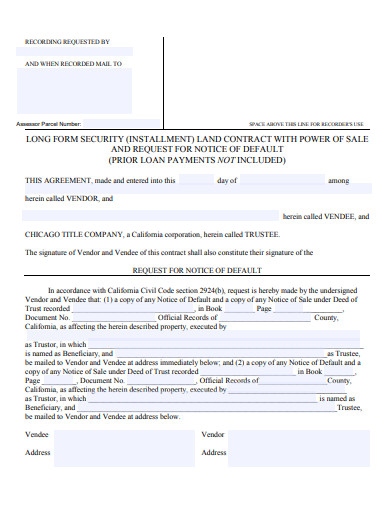

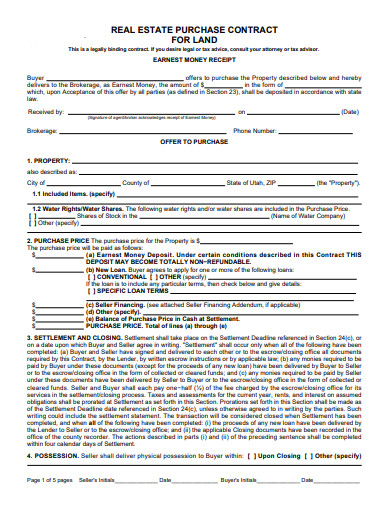

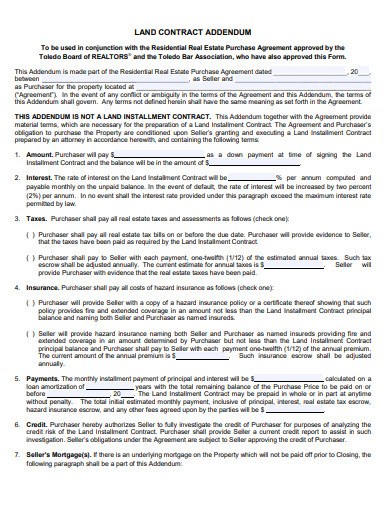

Land Contract Form 10 Examples Format Pdf Examples

Land Contract Form 10 Examples Format Pdf Examples

Katonah 20140910 Book By Nypennysaver Issuu

2

Land Contract Form 10 Examples Format Pdf Examples

Alisha Stockton Residential Real Estate Professional Home Facebook

2

Assumable Mortgage Real Estate Terms Interest Rate Rise Low Interest Rate

2

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Fha Loans Conventional Loan Mortgage Loans

2